Thinking of giving employees a bonus this Christmas? You can give employees a benefit of up to €500. The benefit must only be in tax-free vouchers and not cash.

By using tax-free vouchers to reward your employees not only are you benefiting from them but so is your local community.

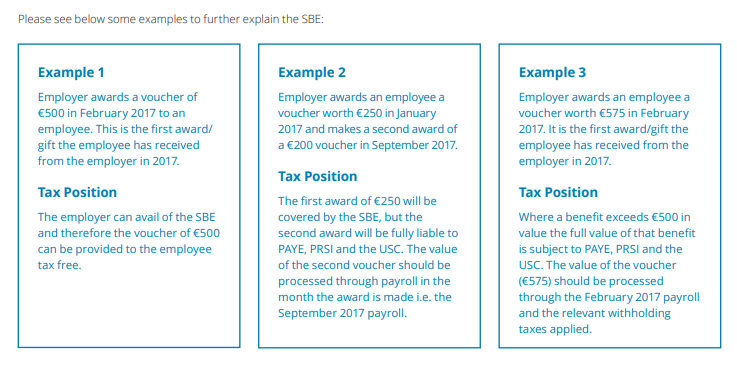

Known as the small benefits exception scheme which was implemented on the 1st January 2016, Revenue is allowing employees to avail of the €500 non-cash benefit on a concession basis immediately.

However, you need to buy the vouchers – up to the value of €500 – before the end of the year. Tax-free vouchers or benefits can be used only to purchase goods or services. They cannot be redeemed for cash.

Prior to 21 October 2015, the limit on small benefits was €250 it has double this year allowing companies to gift employees with up to €500 non-cash benefits.

While the change originally wasn’t going to apply until January 1st, 2016, Minister for Finance Michael Noonan said during a Dáil debate on the Finance Bill in early November that the increased amount of €500 is now effective from the date of publication of the Bill on October 20th 2017.

So How Can Employers Benefit?

Employers are not liable for employer PRSI ( 10.75%) on value of award. The Small Benefit Scheme allows both the employer and the employee to save tax. The employer saves Employer PRSI at 10.75% of the reward (compared to paying it through payroll), and the employee saves 100% of the PAYE and USC that would normally be deducted at source. The combined tax saving is potentially as high as €653.65!

To find out more about the small benefits exception scheme, check out these FAQs from the Revenue Commissioners here.

Source: Delloite

Source: Delloite